Just How to Conserve Money And Time With a Dependable Gas Mileage Tracker

A reputable gas mileage tracker not only automates the tiresome job of recording travel but additionally serves as a powerful tool for taking full advantage of tax deductions and streamlining expense reporting. Comprehending just how to pick and use the appropriate mileage tracker successfully can make all the distinction.

Advantages of Utilizing a Mileage Tracker

Tracking gas mileage effectively supplies many benefits for both individuals and organizations. For individuals, a trusted mileage tracker streamlines the process of documenting travel for personal or professional objectives. This can result in substantial tax obligation reductions, ensuring that eligible expenses are accurately reported and taking full advantage of possible savings. Furthermore, it provides quality in budgeting for travel-related expenses, making it possible for individuals to make informed economic choices.

A reliable mileage tracker simplifies cost reporting, minimizing the administrative worry linked with manual entry. Accurate gas mileage tracking supports conformity with tax regulations, safeguarding firms from possible audits and fines.

Key Functions to Try To Find

When choosing a mileage tracker, a number of essential functions can substantially enhance its effectiveness and use. Most importantly, automated monitoring abilities are crucial. This feature eliminates the requirement for manual entrance, allowing customers to concentrate on their jobs while the tracker documents mileage effortlessly.

An additional essential element is GPS combination. A tracker with general practitioner functionality provides precise location information, making certain that all journeys are logged appropriately and minimizing the threat of errors. Furthermore, look for an user-friendly interface that simplifies navigating and data entrance, making it easy for customers of all technological ability degrees.

A mileage tracker that syncs with mobile phones, tablets, or computers enables users to access their data anywhere, advertising adaptability and comfort. Robust reporting abilities are crucial for assessing gas mileage data.

Top Mileage Tracker Options

Selecting the right mileage tracker can substantially boost your ability to handle traveling expenditures efficiently. The market uses a number of phenomenal alternatives customized to numerous requirements.

One popular choice is MileIQ, which automatically tracks your gas mileage utilizing GPS modern technology. It includes an easy to use user interface and permits for simple categorization of trips, making it ideal for both personal and organization usage. Another solid challenger is Everlance, which not only tracks mileage however additionally supplies receipt scanning and cost tracking, supplying a comprehensive remedy for cost management.

For those looking for a complimentary choice, Stride is an excellent alternative. It allows customers to log miles by hand while also offering understandings right into potential tax obligation reductions. TripLog sticks out for its sophisticated coverage functions and conformity with internal revenue service policies, making it a solid option for company specialists.

Lastly, Zoho Cost integrates mileage tracking with more comprehensive expenditure monitoring devices, ideal for firms looking to streamline their monetary processes. Each of these gas mileage trackers brings one-of-a-kind functions to the table, ensuring that individuals can discover basics the excellent fit for their needs.

Just How to Successfully Use a Gas Mileage Tracker

To make best use of the advantages of a mileage tracker, individuals must first acquaint themselves with its attributes and performances. Comprehending exactly how to input information, classify trips, and accessibility coverage choices is necessary for effective use - best mileage tracker app. Many mileage trackers provide automatic monitoring options via GPS, which enables customers to catch journeys properly without hand-operated entrance

Customers should ensure that the tracker is set to tape-record their car type and objective of travel, whether for service, individual, or charity. This classification helps with better reporting and makes certain compliance with tax obligation policies. Regularly examining and updating gas mileage access is critical to preserving accuracy and completeness.

Additionally, users must discover integration abilities with accountancy or expense monitoring software, which can enhance the process of monitoring expenditures and streamlining tax prep look at more info work. Setting reminders for periodic reporting can assist individuals stay organized and make sure no journeys are neglected.

Tips for Maximizing Savings

Reliable usage of a gas mileage tracker not only enhances record-keeping yet additionally presents possibilities for considerable cost savings. To take full advantage of these cost savings, start by selecting a mileage tracker that integrates seamlessly with your monetary software program. This integration helps enhance expenditure coverage, ensuring you record every eligible reduction.

Next, keep consistent and exact records. Log your mileage quickly after each trip to stay clear of mistakes. Classify your journeys effectively, comparing service and individual traveling, as only business miles receive reductions.

Make use of the coverage attributes of your tracker to examine your traveling patterns. This understanding can disclose unnecessary journeys that can be decreased or eliminated, consequently decreasing fuel costs. Furthermore, consider combining tasks into single trips to optimize index gas mileage use.

Keep notified regarding tax obligation laws pertaining to mileage deductions. The internal revenue service updates these prices yearly, so guarantee you use the correct numbers to your documents.

Finally, assess your gas mileage logs frequently to determine potential cost savings possibilities. This positive method not just boosts economic administration yet likewise encourages extra efficient traveling practices, inevitably bring about raised savings in time.

Conclusion

In final thought, leveraging a reliable mileage tracker offers substantial advantages in time and expense financial savings with automation and precise journey logging. The combination with financial software application enhances expenditure monitoring.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Daryl Hannah Then & Now!

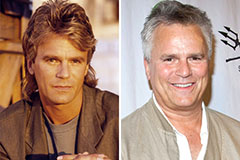

Daryl Hannah Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!